Income Tax, ECONOMIC OPPORTUNITY FOR ALL

A Cautionary Tale: Promises of “Relief” from NJ’s Income Tax – GSI

By William J. Smith, GSI Staff

On Monday, May 17, New Jersey residents will be required to file their tax returns to the state and federal government, slightly a month beyond our traditional pre-COVID, April 15 deadline.

While we dutifully file our returns, many residents are unaware that New Jersey’s Income Tax represents a cautionary tale for public officials proposing “relief” from other tax burdens.

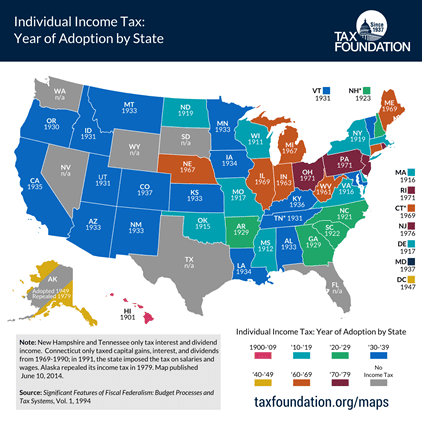

NOTE: Map was produced prior to Tennessee’s 2021 Income Tax repeal

Can you believe New Jersey, with today’s crushing tax burden, was one of the last states to adopt an Income Tax? Hard to believe, but as you can see on the map at right, it’s true.

In fact, until Connecticut extended its Income Tax beyond interest and capital gains to include wages in 1991, New Jersey’s adoption of an Income Tax in 1976 marked the last time a state adopted such a tax. No states have implemented an Income Tax since.

According to an analysis by the Tax Foundation, every state has an income tax except for Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alaska and Tennessee are notable as the only states to repeal an existing income tax (in 1979 and in 2021, respectively), while all the other states on that list have always gone without one. New Hampshire is a unique case, as their income taxes do not and have not ever applied to wage income, instead only taxing interest and dividend income.

The state personal Income Tax was enacted in 1976 during the administration of Governor Brendan Byrne, with its revenues dedicated by constitutional amendment to support public schools and to provide property tax relief.

William J. Smith

The tax began with a simple two-rate structure consisting of a 2% rate on income below $20,000 and a 2.5% rate on income above $20,000. In 45 years, eight brackets have been introduced without any substantive update to account for inflation, making this tax more burdensome over time. The only meaningful change has been to establish a new top rate of 10.75%, which recently moved from third to the fourth highest in the nation, as New York adopted a 10.9% top rate. In Governor Murphy’s FY22 budget presentation, Income Tax receipts were estimated to constitute over $16 billion in revenue, at 35%, the single largest source of funds to the state.

As for the Property Tax “relief” that has been continuously promised to New Jersey residents since 1976?

It is no secret that New Jersey’s property taxes continue to grow and rank as the highest in the nation with an effective tax rate of 2.49%. In 2020, the average property tax bill exceeded $9,000 for the first time, rising to $9,112 per home with collections totaling nearly $31 billion in revenue to support spending by county and municipal governments, and school districts.

A simple lesson: When public officials promise you “relief” in the form of a new tax but fail to act to rein in spending – Caveat emptor!

Happy Tax Day!