Uncategorized, AFFORDABLE PLACE TO LIVE

Is the Tax Reform Revolution Passing New Jersey By?

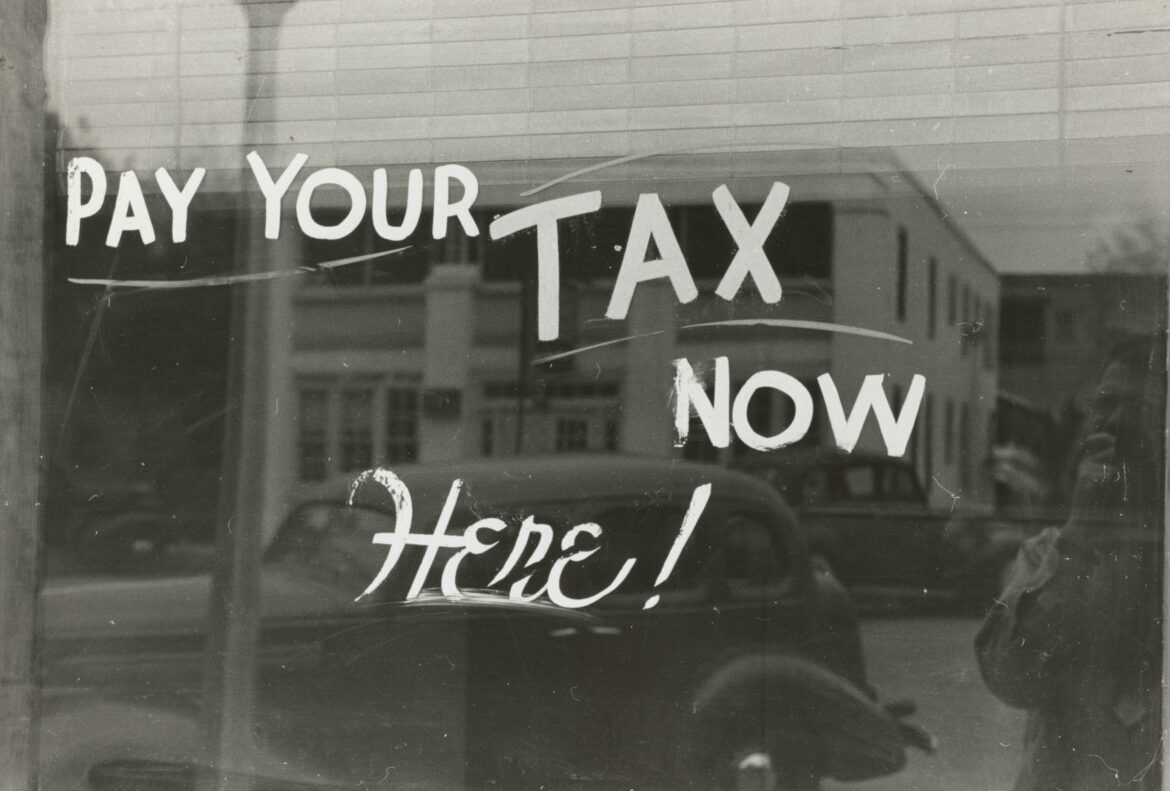

In a little more than a month, on April 18th, New Jerseyans will face the deadline to file their tax returns. Unlike their fellow Americans in dozens of states, Garden State residents will find very little has changed in a tax code that places us among the highest income taxes in the nation. While it has gone unnoticed by many New Jersey residents, a state tax reform revolution has been going on all around us.

According to an analysis by the non-partisan Tax Foundation, in 2022, 12 states enacted individual income tax rate reductions, building on 2021 when 13 states enacted or implemented individual income tax rate reductions. While nearly all of the 2022 rate reductions were effective on January 1, Georgia’s rate reduction will occur in 2024 along with additional tax cuts in Iowa, Mississippi, and Nebraska.

While those states are considered to be “Red” states, the tax cut wave has also washed ashore in traditional blue states as well, with Democratic governors in New York and North Carolina pushing for income tax cuts or continuing phased-in reductions.

Beyond simply reducing their income tax rates, currently 8 states collect no income tax, with New Hampshire on a trajectory to being the 9th shortly. And the momentum shows no sign of slowing down. In fact, according to an estimate by Grover Norquist of Americans for Tax Reform 10 to 15 states could credibly be considered on a path to eliminating their income taxes.

It’s no coincidence that those states that have undergone significant tax reforms are among the leaders in population and economic growth. While those who continue to tax and spend unabated are headed in the opposite direction. GSI’s recent report on the state’s position as an outlier with high corporate business taxes lays out the facts (Page 10) in detail on New Jersey has been a state in decline with a stagnant economy and population compared to the U.S.

No one can reasonably expect a high-income tax state like New Jersey to suddenly eliminate its income tax overnight, but it can make a commitment to taxpayers by following the example of North Carolina, a destination for so many Garden State residents and businesses.

A decade ago, North Carolina, once a high tax and spending state, embarked on a mission to transform its fiscal and tax climate. The Tarheel State committed to restrain spending , move to a flat income tax and halve its income tax rate by 2026. Additionally, the state has lured investment by moving to phase out its business tax. It’s a model of success that inspired numerous states to embark on the same path across the nation.

While New Jerseyans get prepared to file their tax returns on April 18th, it would be a good time to ask those representing us in Trenton why our taxpayers are missing out on the revolution in tax reform.