Public Spending, ECONOMIC OPPORTUNITY FOR ALL

Study: New Jersey’s Unnecessary and Mismanaged Debt Stands Alone – GSI

By William J. Smith, GSI Staff

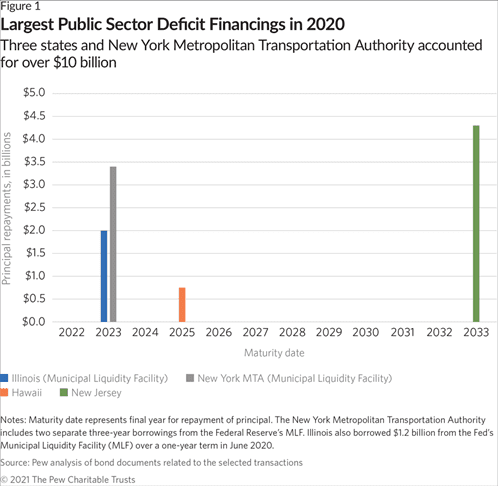

A new study from the Pew Trusts illustrates how much of an outlier New Jersey’s decision to borrow $4.3 billion to shore up budget revenues truly was. New Jersey’s $4.3 billion in new debt accounted for the lion’s share of $10 billion that was borrowed nationwide by public entities in anticipation of revenue shortfalls, with only two other states borrowing in anticipation of potential revenue deficits.

Click to enlarge

The other two state governments that borrowed, Hawaii and Illinois, were in marked contrast to New Jersey. According to Pew, Illinois borrowed $1.2 billion from the Federal Reserve’s Municipal Liquidity Facility repayable over one year. Hawaii’s $748 million bond issuance in October 2020 offers the best illustration of where New Jersey went wrong. Pew states: “…repaying the money will require only about $150 million from the budget each year from fiscal 2022 through fiscal 2026—by which time revenues will be growing at a healthy pace again, according to the state’s regular five-year forecast.”

New Jersey, in contrast, took a worst-case scenario, in spite of disagreement from both experienced legislators and former treasury officials, and continued on a path of borrowing, ignoring the clear strength that was being delivered in the top revenue-producing lines of the budget.

New Jersey’s handling of the debt is also an outlier in that the bonds were issued as non-callable, meaning they cannot be repaid earlier; saddling taxpayers with interest payments to bondholders for 12 years. The state will make interest-only payments in 2021 and 2022 and analysts say taxpayers will be on the hook for annual debt service payments on the bonds of just over $500 million a year for 10 years.

As Pew noted, “In contrast to Hawaii’s five-year borrowing supported by a revenue forecast process tracking the same time period, New Jersey issued noncallable 12-year financing—meaning there’s no opportunity for early repayment—informed by revenue projections that span only two years. In the meantime, the economy and revenues have improved. That’s the good news. But because early repayment is not an option, there is also a greater risk that the borrowed funds will lead to longer-term structural deficits.”

William J. Smith

If you’re familiar with the Garden State Initiative you know that we were among the earliest and most outspoken voices last year in opposition to a proposal from the Governor and legislature to borrow billions of dollars under the of a pandemic-induced revenue shortfall. We argued that legal arguments aside, the proposal was premature, excessive and added additional billions of dollars and years of debt service to one of the most indebted and highly-taxed states in the Union.

While state revenues have surged to boast of the strongest tax collections in state history, our state is saddled with the burden of long-term payments of borrowing $4.3 billion to fund a fiscal emergency that never happened.

According to our state’s 2020 Debt Report, future generations are saddled with over $200 billion of debt. Bonded debt alone consumes over $4 billion in servicing fees each and every year. While last year’s borrowing, which Senate President Sweeney now calls “regrettable”, is baked into the cake, along with those surging tax revenues and billions in federal aid, our leadership in Trenton can act by taking meaningful steps to cut spending and reduce debt as part of the budget due on June 30th and avoid the structural deficits Pew sees lying just ahead.