Business Tax, AFFORDABLE PLACE TO LIVE

GSI President Egea: Dem Plan to Increase Taxes Will Make NJ Anti-Business (Op-ed)

The following op-ed was published on NJ.com and in the Sunday Newark Star-Ledger on June 17, 2018

By Regina M. Egea

Last month Garden State Initiative hosted an Economic Policy Forum that was a gathering of thought leaders and an opportunity for an exchange of ideas from across the political spectrum in government, academia and business. A common theme was a need to put partisanship aside and produce solutions.

Included was the release of our report “

Those quotes give a clear indication that New Jersey is rapidly reaching a tipping-point when it comes to our ability to retain and lure job creators to our state.

Recent news reports indicate that state Senate President Steve Sweeney is again proposing a 3 percent increase on corporations earning more than $1 million in annual net income to raise nearly $700 million in revenue.

New Jersey does not have to wait until it’s “too late” to see the results of short-sighted policies like this proposal.

Our analysis already shows what the expected impact of raising corporate business tax rate will be…an uncompetitive environment for the job creators who provide good paying jobs to New Jersey’s workforce.

New Jersey’s current corporate business tax, known more generically as CIT (corporate income tax), is higher than every state in the six-state sample except Pennsylvania.

Any CIT surcharge under consideration in our Legislature, if imposed, would make New Jersey even less competitive than those states it is already lagging behind, such as Ohio and North Carolina, and reduce any current advantage it has over states like Connecticut and Pennsylvania.

Current law shows that while New Jersey is presently competitive with nearby states such as Pennsylvania (which has an almost 10 percent corporate rate) and Connecticut, it is far outpaced by Ohio and North Carolina.

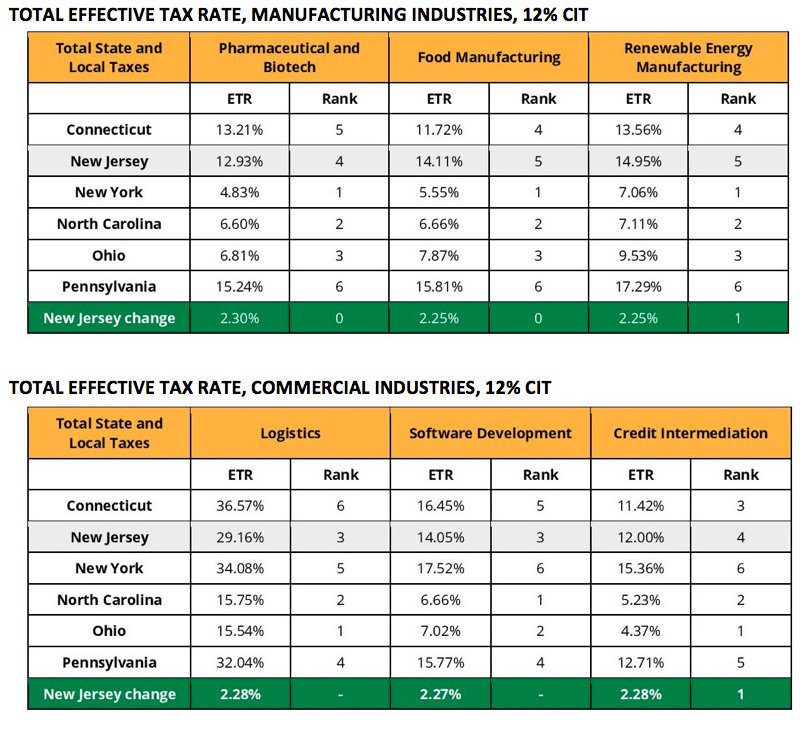

The figures below model the results of a 12 percent rate i.e. including a 3 percent surcharge. New Jersey becomes much less attractive for manufacturing firms.

Increasing the top business tax rate by 33 percent would more firmly establish it as more like the non-competitive states: New York, Connecticut and Pennsylvania. Today’s 9 percent rate makes New Jersey generally the most competitive among those three non-competitive states.

While that reputation is not ideal, it is certainly preferable to being a definitively non-competitive state. But that would be its status were the CIT 3 percent surcharge to go through, making New Jersey a national leader for all the wrong reasons.