Public Spending, ECONOMIC OPPORTUNITY FOR ALL

GSI Poll: NJ Voters Want Benefits Reform, Government Savings not Tax Increases or Borrowing to Close State Deficit

Tax increases are ranked as least preferred option by every demographic subgroup of voters

As the effects of the COVID-19 pandemic on the State of New Jersey’s finances begin to emerge, residents of the state have a clear message to Governor Murphy and legislative leaders:

“Reform public employee benefits and reduce the cost of government before you consider raising taxes”

That is the conclusion of a survey of 500 registered, likely voters in New Jersey conducted for the Garden State Initiative by National Research Inc.

Last Wednesday, the Murphy Administration announced that the state is facing a revenue shortfall of approximately $10 billion. A day earlier, NJ.com’s Samantha Marcus reported the state’s public employee pension system, the 2nd worst funded in the nation, added $10 billion in additional debt as of July 1, 2019. This leaves New Jersey’s pension system at a funding level of 58.6% of the $174 billion in liabilities or $72 billion short of what is needed to pay retirement benefits to 800,000 active and retired public employees. Those figures do not yet include any impact of the COVID-19 pandemic on stock market investment returns.

“By significant margins, New Jersey voters recognize that tax increases are not the right prescription to get New Jersey’s fiscal house in order,” said GSI’s president Regina M. Egea. “Common sense reforms, that put public employee benefits on par with the private sector, coupled with measures to reduce the cost of government, enjoy broad popular support among voters.”

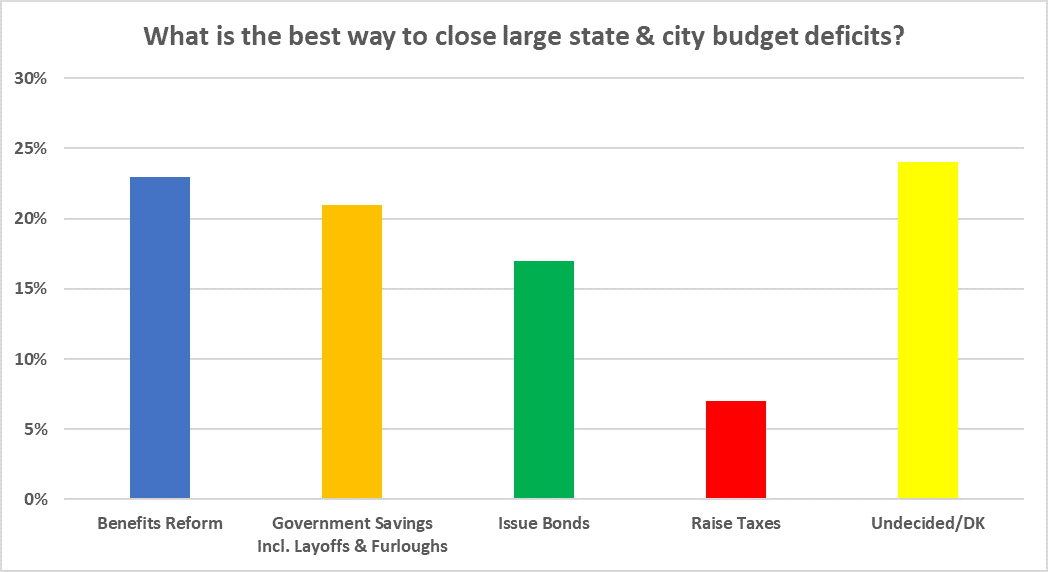

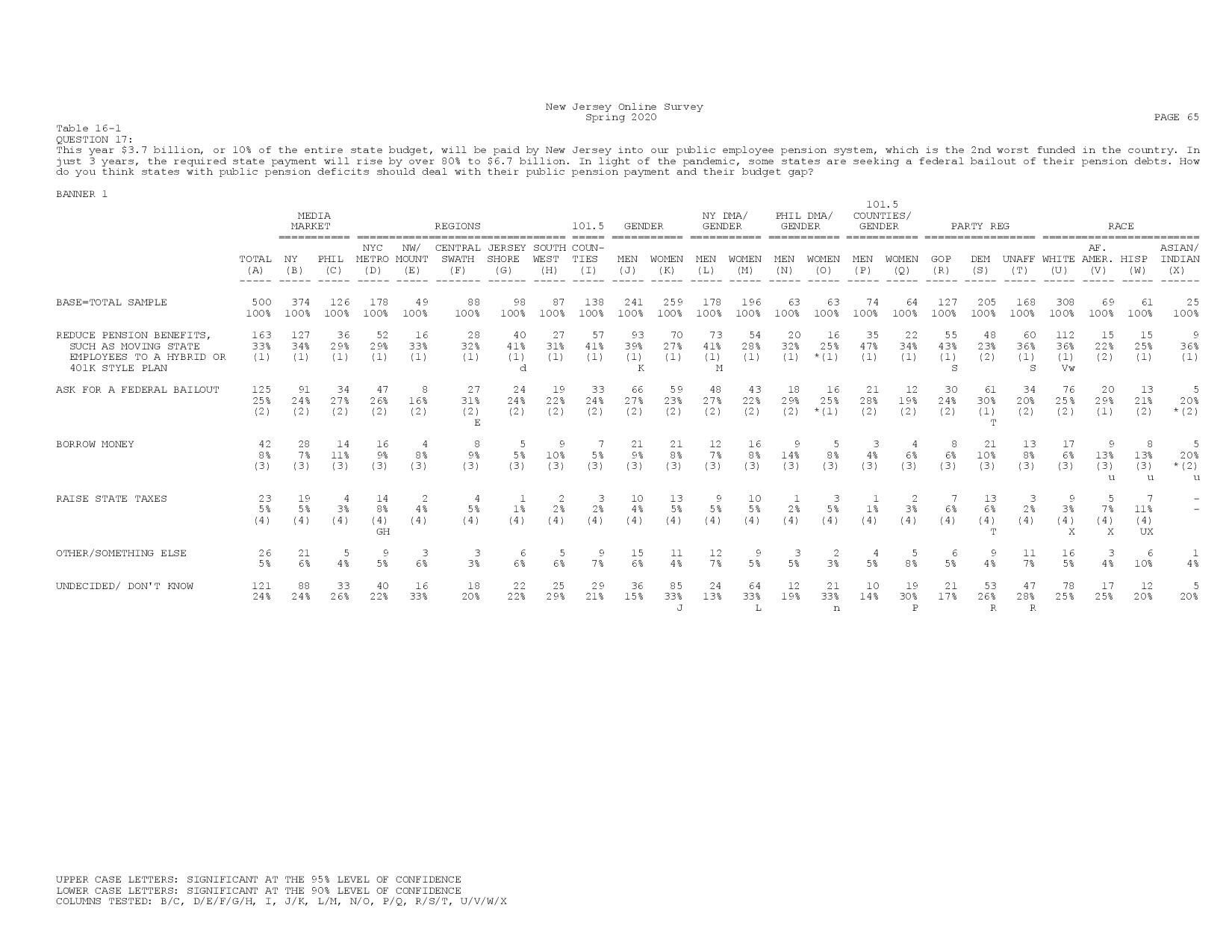

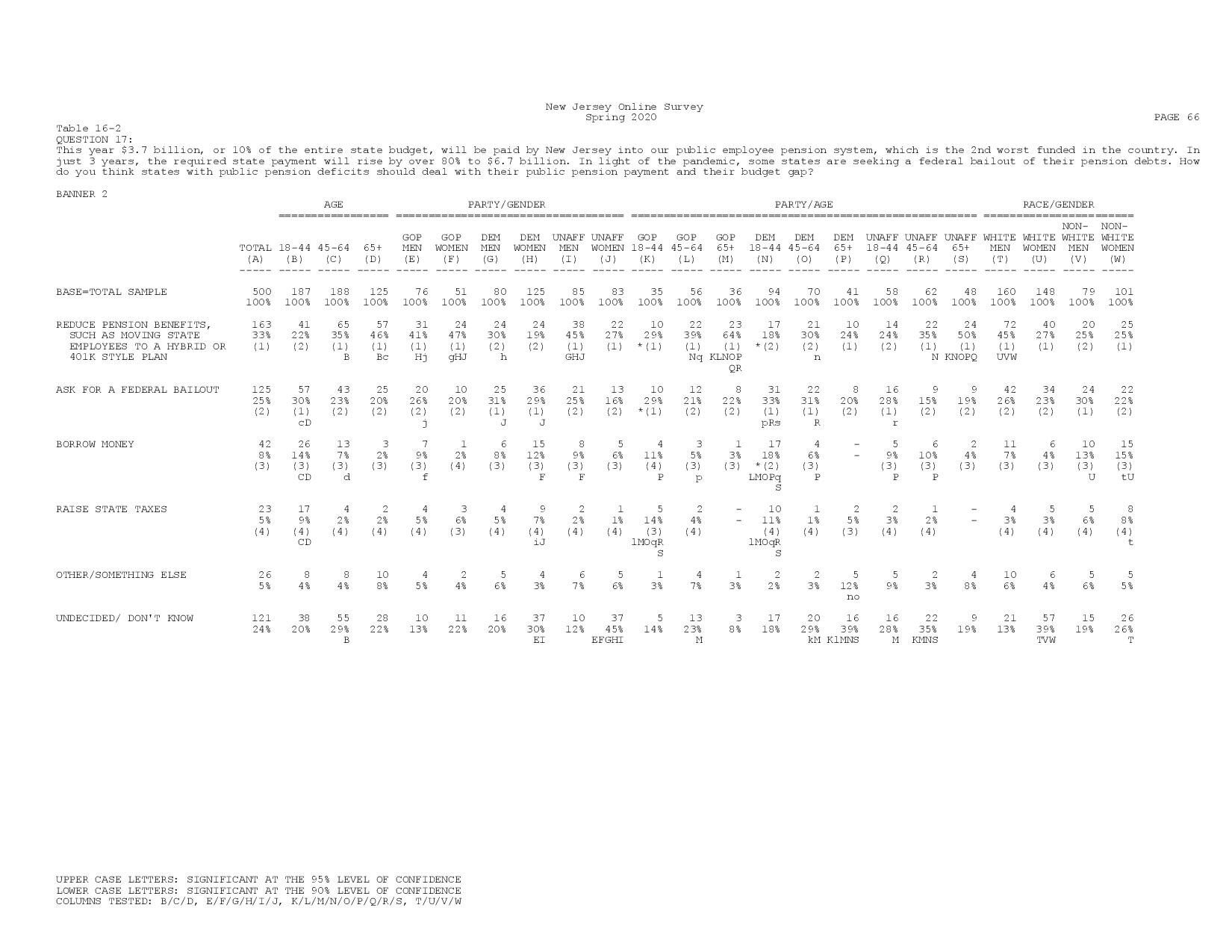

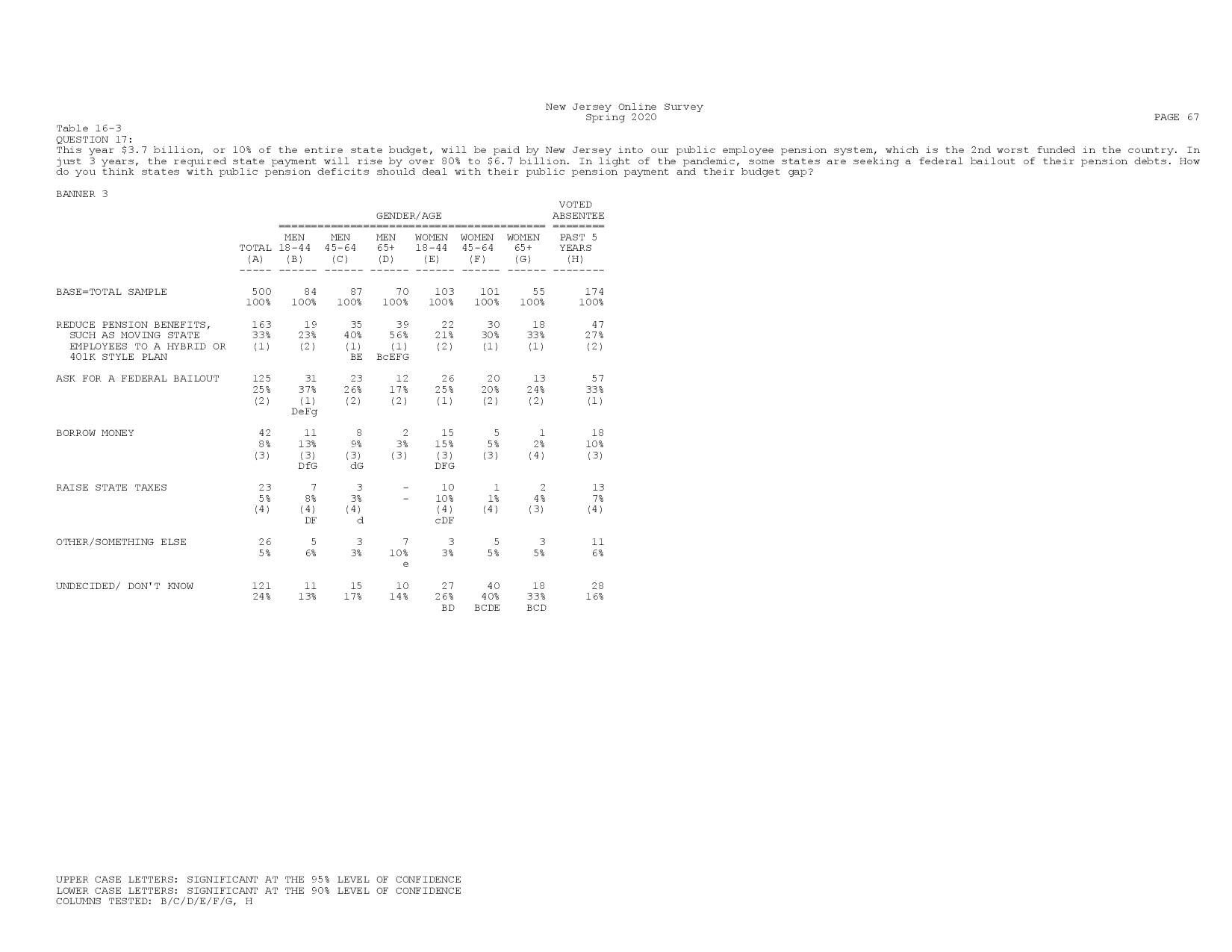

When asked about closing large budget deficits for the State and large cities, nearly half of respondents (44%) chose financial savings measures like updating public employees’ benefits to mirror private employers’ pension and health benefits (23%) and finding cost reductions in government operations including layoffs, furloughs, salary freeze, etc. (21%) over issuing bonds (17%) or raising taxes (7%). Of note, the option of increasing taxes was the least preferred option of every demographic subgroup surveyed.

GSI/National Research Inc. Poll of 500 registered, likely voters 4/28-4/30

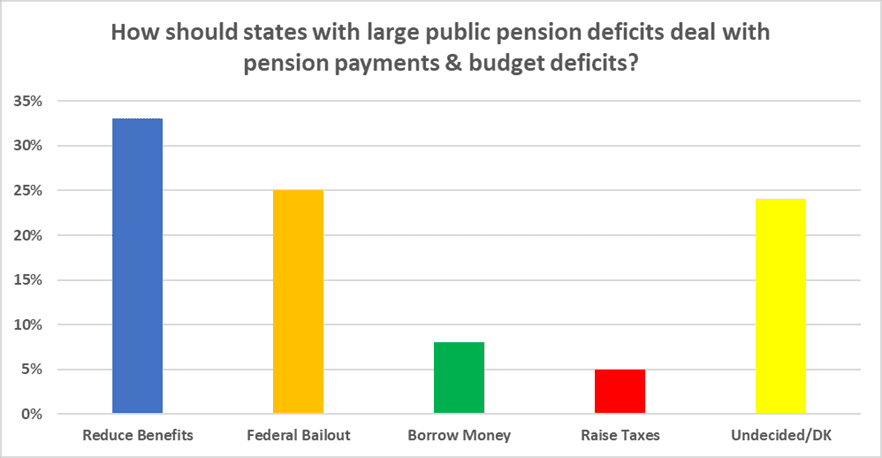

Voters broadly support (33%) updating public employee benefits, such as moving state employees to a hybrid or 401K style plan, as a solution to a budget gap. While a federal bailout was supported by a significant percentage (25%) there was widespread opposition to adding to our state’s debt by borrowing (8%) or raising taxes (5%). The option to raise taxes or borrow money were again at the bottom of respondents’ priorities when viewed by demographic subgroup.

GSI/National Research Inc. Poll of 500 registered, likely voters 4/28-4/30

Methodology

The preceding is based on an online poll of 500 registered, likely voters in New Jersey, conducted by National Research Inc. The survey was conducted April 28-30, 2020, and has a margin of error of +/- 4.38% at the 95% confidence interval.

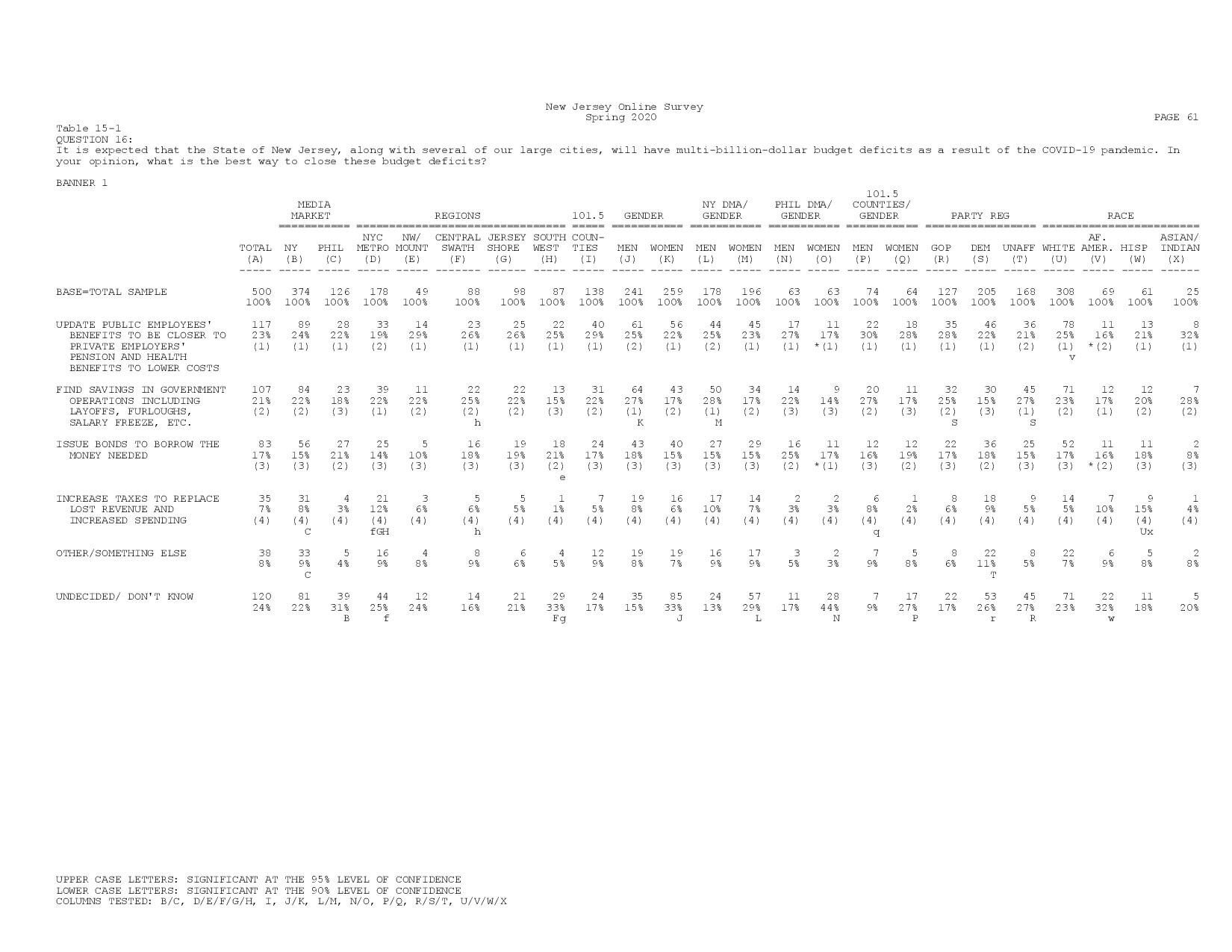

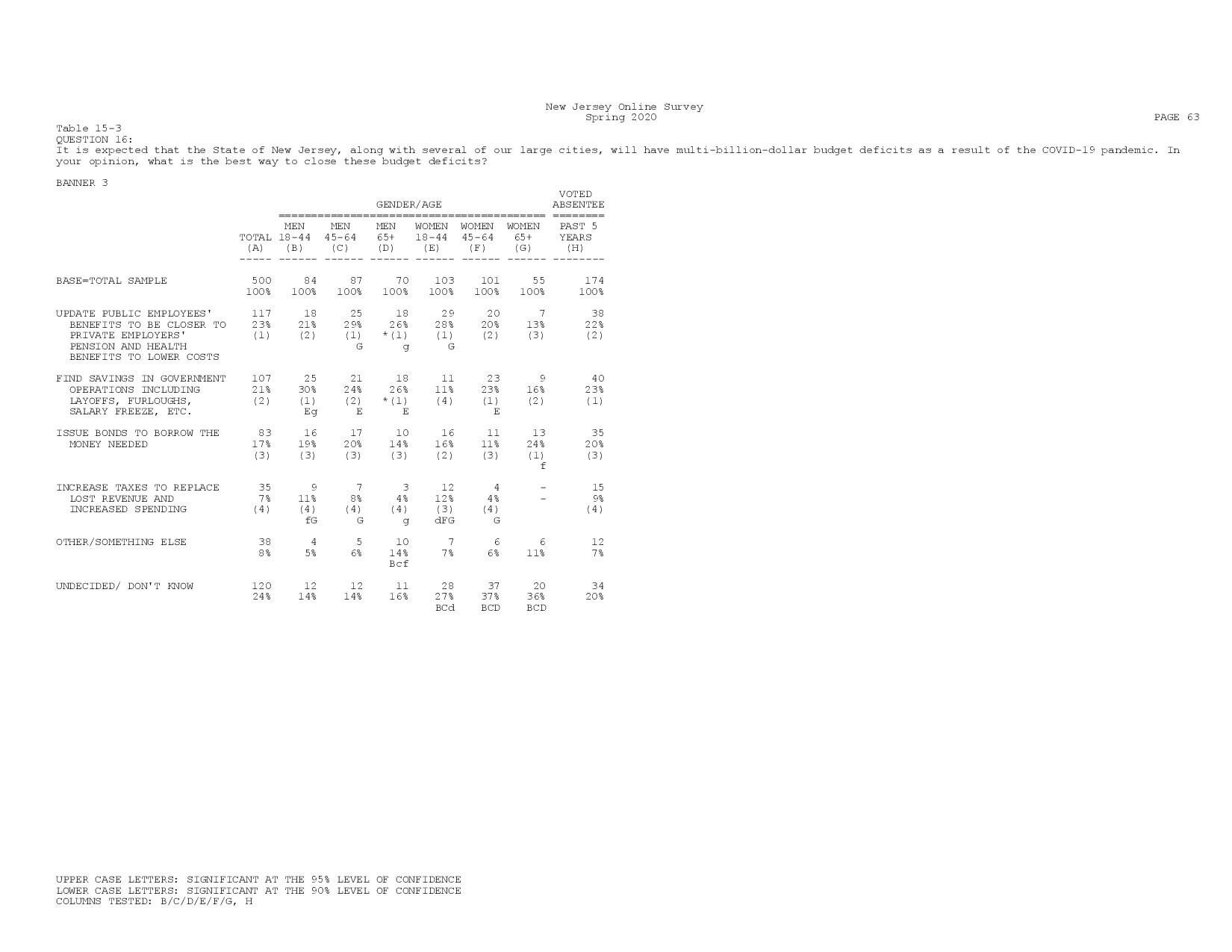

Tables

(click on item to enlarge)