TRANSFORMING OUR BUSINESS CLIMATE

New Jersey’s Red Tape & Fees are Hurting Small Businesses

Analysis for GSI by Danielle Zanzalari, Ph.D.

New Jersey ranks near the bottom or at the bottom, depending on the source considered, for overall business climate due to taxes and regulatory hurdles. The factors behind those rankings directly impact the ability of our state to foster the development of small businesses and retain those businesses as they grow. It is important to want small businesses to exist and thrive in your state. Small businesses are a way for new innovations to come to the market and for New Jersey residents to accumulate wealth.

While a new small business manual has been proposed to help small businesses navigate common questions such as “how to get a permit”, which can help, there are better ways for Trenton to make it easier for small businesses to exist.

New Jersey’s main problem is business applications have risen, but business formations are down in the Garden State, and there are a number of reasons why:

- It is costly to register/keep a small business (LLC) relative to neighboring states;

- New Jersey has a lack of workers due to laws creating unneeded jobs;

- There are laws that make it difficult to start jobs (like occupational licensing laws) ; and

- Recent legislation has not been supportive of small-business

Do Businesses Want to be in New Jersey?

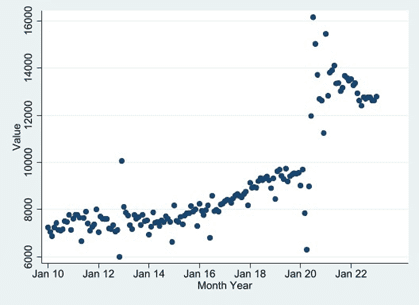

Business application data does not support the argument that people do not want to start businesses in New Jersey.

Census data shown here suggests that business applications are vastly up from the pre-pandemic era. Specifically, there is a large uptick in June 2020 (likely due to the federal government’s Paycheck Protection Program), but new business applications are still higher after this initial time period. The jump is likely due to people responding to pandemic job losses, the changing environment of work-from-home, and supply-chain issues. This indicates people are wanting to start their own business in New Jersey.

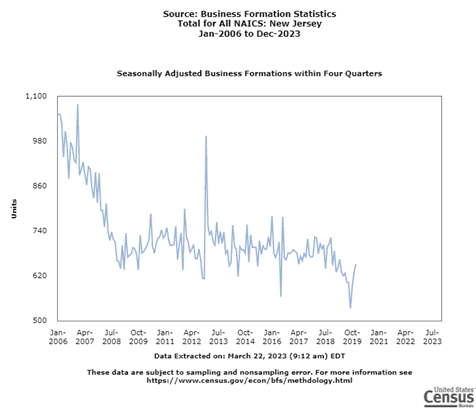

The problem is new business formations, as measured from the Census, are down. This means that while people are applying for new businesses, it is more difficult to actually become a business in New Jersey.

There are a number of reasons why this downward trend has been occurring:

-

New Jersey is not the best choice among neighboring states to start a business.

It is more expensive to register as a business compared to NY and PA, our immediate neighbors. Delaware is the only neighboring state that is more expensive to start a small business in based on filing and annual fees, but businesses can save money opening in Delaware because they do not have state or local sales tax. So, for small businesses that may conduct many sales the higher Delaware registration fee may be worth it relative to paying sales tax.

| Nearby State LLC Filing and Annual Fee Schedule | ||||

| State | Filing Fee | Annual Fee | Frequency of Annual Fee | Total LLC Registration for 5 years |

| NJ | $125 | $75 | yearly | $500 |

| NY | $200 | $9 | biennial | $218 |

| PA | $125 | $70 | every 10 years | $125 |

| DE | $90 | $300 | yearly | $1,590 |

-

Small companies account for 85% of all hiring—an entry point for many workers in the workforce, but there are not enough workers to find to start a business.

-

- Eliminating rules such as requiring people to pump gas for our cars or having toll workers available for payment on tollways would free up workers to work in more productive roles.

- It also does not help that we are not gaining workers in net migration. Despite the rise in NYers moving to NJ during the pandemic, our state has seen workers leaving more than entering our state.

-

Occupational licensing restrictions in New Jersey are unfairly tough (ranked 14th as the most burdensome in the nation) and a barrier to starting a new business.

-

- The Institute for Justice reports that 422 calendar days are lost yearly due to burdens for licensed occupations.

- For example, New Jersey has one of the highest burdens for security alarm installers nationwide and the highest in the region. Security alarm installers in New Jersey must obtain 1460 hours of education and have four years of experience. New York requires just 81 hours and no experience. Delaware requires simple registration and Pennsylvania does not require a license to offer the services.

- Similarly, New Jersey has the highest licensing requirements for locksmiths in the nation. They must have three years of experience to obtain a license, which no other state requires. Thirty-nine states do not require a license, including all three neighboring states.

- New Jersey also requires that an individual must have a barber or cosmetology license (or be in school to obtain one) to be a shampoo assistant that only washes and dries hair—but does not use any chemicals.

-

Through recent legislation, Governor Murphy has not shown enough support for small businesses.

-

- Despite a Democratic-controlled Legislature and Senate overwhelmingly passing a bill creating a permanent commission to review regulations and rules on businesses that hurt economic growth, Governor Murphy vetoed it in 2021. Reviewing burdensome and anti-growth regulations can help minimize the difficulty of operating a small business in our state.

- Recently in April 2023, the WARN Act signed by Governor Murphy became effective. It guarantees workers in businesses with over 100 employees one week of severance pay for year of severance when layoffs impact more than 50 workers, as well as 90 days notice of layoffs.[1] No business wants to lay off workers if they are not performing well, but this legislation potentially further punishes small businesses when they are down.

Click above to download a copy of the report

About the Author

Danielle Zanzalari, Ph.D. is an Assistant Professor of Economics at Seton Hall University, her alma mater. Dr. Zanzalari joined Seton Hall from the University of North Texas – Dallas where she was also an Assistant Professor of Economics. Previously, she worked as the Vice President of Credit and Portfolio Risk at Citigroup and as a Financial Economist at the Federal Reserve Bank of Boston. She helped design the econometric evaluation guidelines for bank stress testing while at the Fed and also helped oversee model development for Citigroup.

About The Garden State Initiative

The Garden State Initiative is a 501(c)3 nonprofit organization dedicated to strengthening New Jersey by providing an alternative voice and commonsense policy solutions in the state — solutions that promote new investment, the growth of businesses, the creation of economic opportunities, and innovation to the benefit of all New Jerseyans. GardenStateInitiative.org

[1] While the Census’ definition of a small business ranges by industry and revenue, small business can constitute for 100 to even over 1,500 employees.