Income Tax, Unemployment, ECONOMIC OPPORTUNITY FOR ALL, GOVERNMENT THAT WORKS

GSI’s EGEA: Combination of Declining Revenues & Rising Unemployment Spell Trouble for New Jersey

Governor Murphy and the State Legislature need to confront the reality of declining revenue and propose solutions to reduce spending

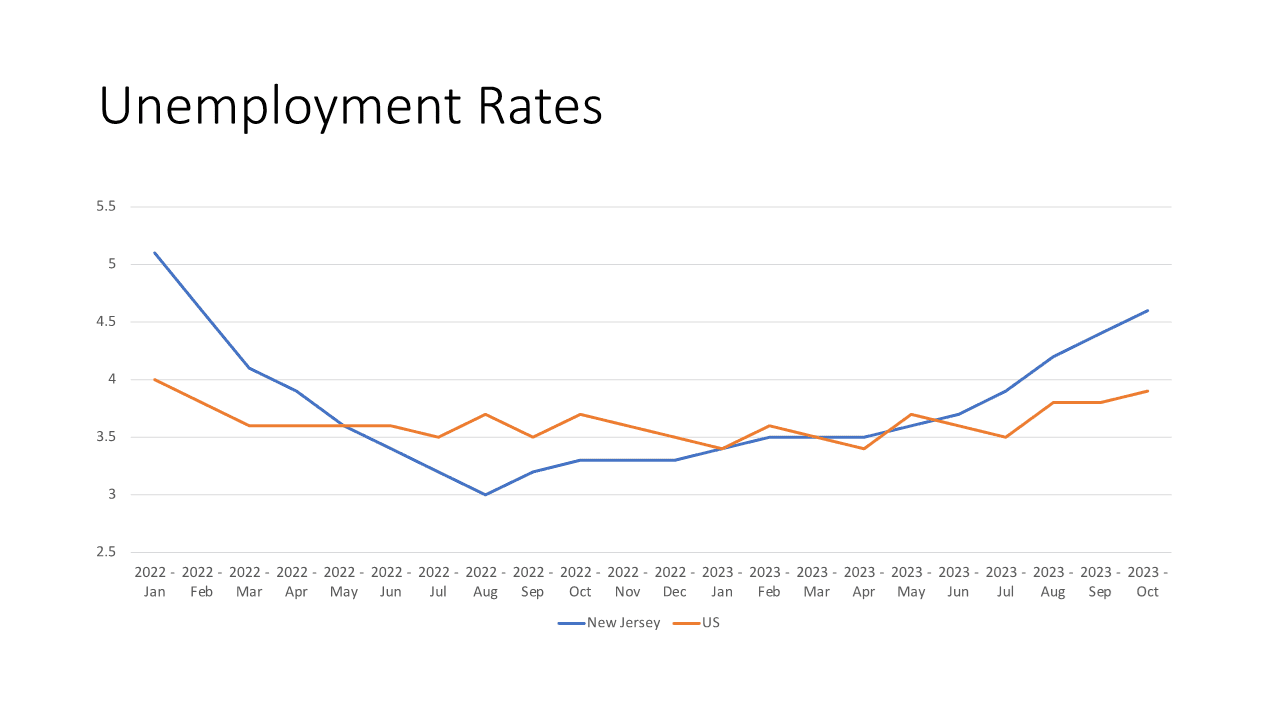

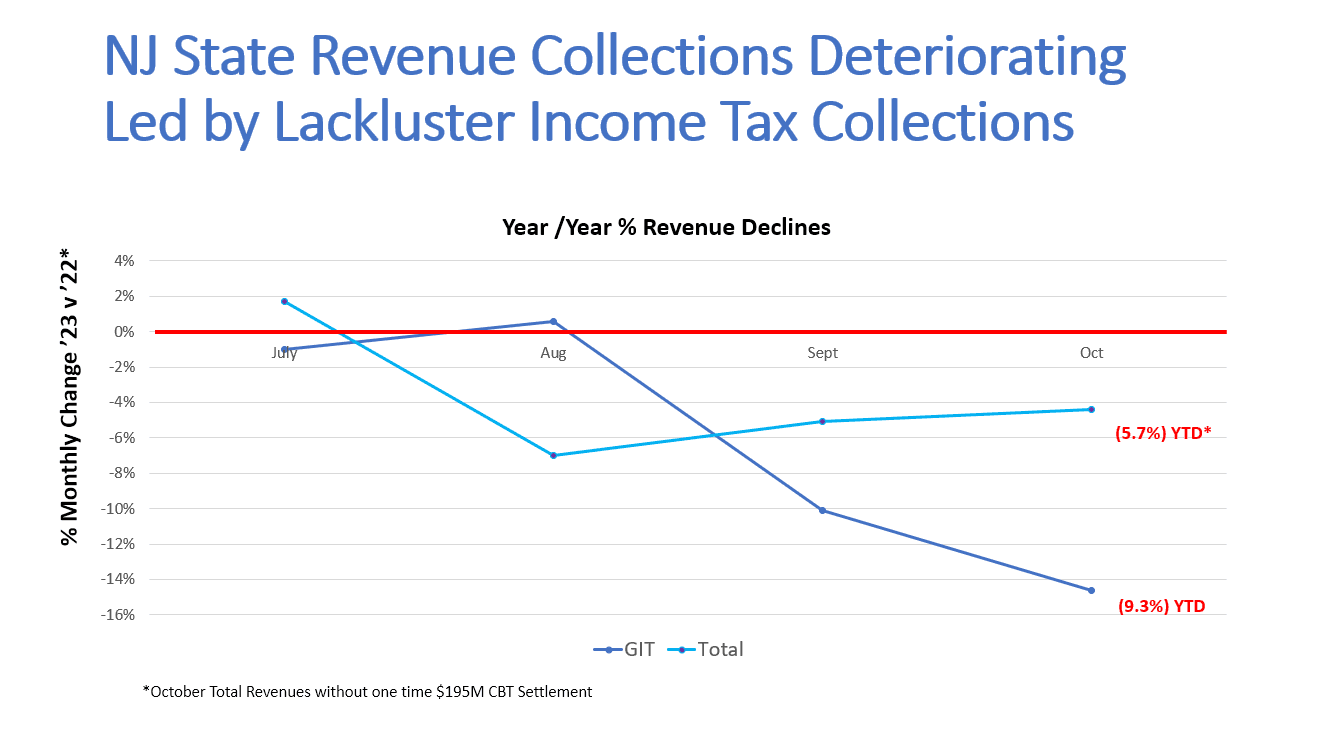

The one-two punch reporting of New Jersey’s escalating unemployment rate of 4.6%, for months above the relatively stable national average of 3.9%, and now a State Treasury Department report showing year-to-date Personal Income Tax (GIT) revenue down a breathtaking 14.6% for the same month last year, it’s time for the governor and state legislature to stop trying to convince state taxpayers that “everything is fine” when they know it’s not.

Garden State Initiative President Regina Egea said that were it not for the infusion of a $195 million multi-year settlement payment received under the Corporate Business Tax, total state revenues would be down nearly $650 million – a 5.7% drop YTD over last year, not the (4%) Treasury reported today.

“Facts are Stubborn Things’ as John Adams famously noted. Using creative math might make the results sound less ominous, but avoiding reality is a recipe for failure for everyone in our state,” said Egea.

“This month, there are over 22 thousand fewer people working in New Jersey, and concurrently we have experienced a decline of the largest revenue line for the state, (personal income taxes). These are two flashing red lights for anyone concerned about our state’s economic health,” said Egea. “But instead of confronting those realities and getting ahead of it by changing course, policy makers have downplayed it and sought to reassure residents that ‘everything is just fine’. Absent corrective action, New Jersey taxpayers and business owners are in for a rough 2024.”