Public Spending, GOVERNMENT THAT WORKS

Report Card: New Jersey Earns D- for Failure to Address Pension Crisis

From GSI Staff:

As students around the country are taking their final exams before winter break, the state of New Jersey received a report card for managing its debts, specifically pension and benefit costs for public employees, and it is far from pretty. The non-partisan Volcker Alliance, founded by former Federal Reserve Chair Paul Volcker, rated the state a D- for its failure to have properly “provided adequate funding, as defined by retirement system actuaries, for pensions and other promised retirement benefits for public workers.”

New Jersey was one of six states to receive the lowest possible grade in the analysis, along with Hawaii, Illinois, Massachusetts, Texas and Wyoming.

As of June 2017, the Garden State has funded only 36% of its pension debt with an unfunded liability of $143.2 billion, 2nd worst in the nation behind Kentucky’s 34% funding.

The grade was included in the 2018 Volcker Alliance report, Truth and Integrity in State Budgeting: Preventing the Next Fiscal Crisis, which, in addition to legacy costs, grades and proposes a set of best practices for policymakers on issues including: budget forecasting, budget maneuvers, reserve funds and transparency.

The report adds fuel to the fire of support for pension and benefits reforms proposed in the recent “Path to Progress” report issued by State Senate President Steve Sweeney’s bi-partisan New Jersey fiscal policy working group.

· Shift new state and local government employees and those with less than five years of service in the Public Employees’ Retirement System and the Teachers’ Pension and Annuity Fund from the current defined benefit pension system to a sustainable hybrid system and preserve the current system for employees with over five years of service who have vested contractual pension rights.

· Shift all state and local government employees and retiree’s health care coverage from Platinum to Gold.

· Require all new state and local government retirees to pay the same percent of premium costs they paid when working.

· Merge the School Employees Health Benefits Program into the larger State Health Benefits Plan and make the plans identical in coverage.

While formal legislation has yet to be introduced regarding Senator Sweeney’s proposals, reports indicate that bills will be introduced by the end of the year or early 2019.

If Governor Murphy and the legislature have the political courage to act on these proposals, at this time next year, New Jersey could move from a D- to Most Improved!

Courtesy Volcker Alliance State Budget Practice Report Cards and Budget Resource Guide

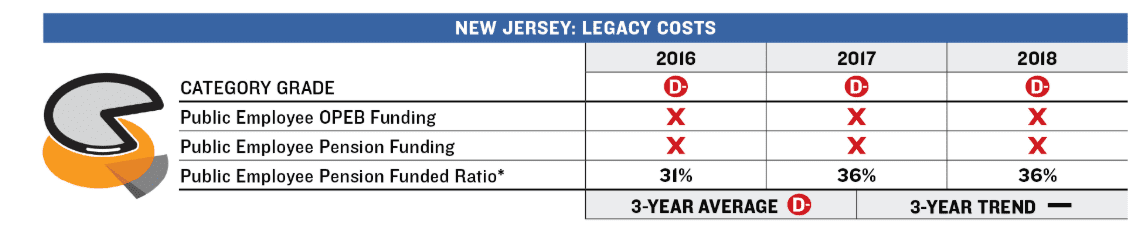

From the Volcker Report Card: This table contains assessments of states’ ability to meet promises made to public employees for pensions and other retirement costs for fiscal 2016 through 2018. States are graded on a scale of A to D-minus, the lowest possible, on whether their contributions to public employee pension funds were effectively 100 percent of the actuarially required or determined contributions (ARC or ADC), adjusted for any unfunded liabilities; and whether their contributions to any public employee other postemployment benefit (OPEB) plans were effectively 100 percent of the ARC or ADC.

While New Jersey has showed improvement from 31% funding in 2016, it should be noted that in fiscal year 2018, New Jersey temporarily shifted ownership of the state lottery and its proceeds to the retirement funds for teachers, public employees, and police officers and firefighters. The move made the pension system appear better funded, but the net amount being injected by the state is not scheduled to reach the ARC level until fiscal 2023. The shortfall continues to deprive the pension system of any possible earnings on the sums that actuaries say should be contributed.