GOVERNMENT THAT WORKS

Report: NJ Worst of the Nation’s Sinkhole States

From GSI Staff:

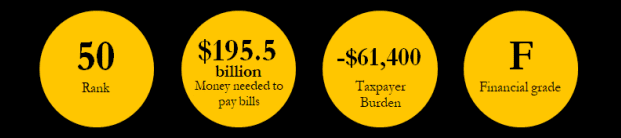

The State of New Jersey continues to win titles that no one wants. This time ranking 50th in fiscal health, receiving an “F” grade in the 2018 Financial State of the States report from the non-partisan organization Truth in Accounting (TIA), whose goal is to ensure that governments provide truthful, timely, and transparent financial information to their citizens. TIA analyzes government finances on the city, state, and federal level.

A new analysis by TIA of the latest available audited financial reports found that New Jersey has a Taxpayer Burden™ of $61,400, earning it an “F” grade based on Truth in Accounting’s grading scale. The Garden State was also ranked as the nation’s leading Sinkhole State, meaning that it owes more in debts that it owns in assets.

New Jersey faces a $195.5 billion shortfall, which equates to $61,400 for every taxpayer. Most of the state’s overall debt comes from contractually protected pension benefits and retiree health care costs. Of the $223.5 billion in retirement benefits promised, the state has not funded $103.5 billion in pension and $71.9 billion in retiree health care benefits.

While New Jersey’s financial statements indicated an annual deficit of nearly $11 billion, the state’s financial condition seemingly improved because the actuaries of the state’s retirement systems increased the percentage rates used to determine the current value of promised benefits, which led to a decline in liabilities.

Some fast facts from the Truth in Accounting research:

New Jersey owes more than it owns.New Jersey has a -$61,400 Taxpayer Burden.™

New Jersey is a Sinkhole State without enough assets to cover its debt.

Elected officials have created a Taxpayer Burden™, which is each taxpayer’s share of state bills after its available assets have been tapped.

TIA’s Taxpayer Burden™ measurement incorporates both assets and liabilities, not just pension debt.New Jersey only has $25.5 billion of assets available to pay bills totaling $221 billion.

Because New Jersey doesn’t have enough money to pay its bills, it has a $195.5 billion financial hole. To fill it, each New Jersey taxpayer would have to send $61,400 to the state.

New Jersey’s reported net position is inflated by $27.7 billion, largely because the state defers recognizing losses incurred when the net pension liability increases.The state is still hiding $34.3 billion of its retiree health care debt.

A new accounting standard will be implemented in the 2018 fiscal year which will require states to report this debt on the balance sheet.The state’s financial report was released 272 days after its fiscal year end, which is considered untimely according to the 180 day standard.

Courtesy of Truth in Accounting