Unemployment, TRANSFORMING OUR BUSINESS CLIMATE, Labor

GSI Analysis: Nov. ’18 Jobs Report: Employment Picture Remains Sluggish, With Warning Signs Flashing

-

New Jersey economy is growing, but slower than the national economy. Those facts paired with recent local business and political news likely means New Jersey will not be resilient during the next and inevitable market downturn.

-

New Jersey workforce growing, but still smaller than it was in 2008.

-

The state lost primarily white collar jobs over the last month.

Garden State Initiative (GSI) analysis of November’s jobs report for New Jersey was a mixed bag. The state’s workforce continued its (slightly slower) growth for the fifth consecutive month. But the state lost 800 private sector jobs—many in white collar industries—which, along with recent local business and political news, could leave the state’s economy exposed to suffer in a recession.

“Although the report of a 4.0% unemployment rate will get the headlines, there is significant cause for concern regarding the labor market in New Jersey,” stated GSI president Regina M. Egea. “Our growth lags the national economy, we continue to see the effects of a hostile climate for business, and the Governor’s threat of new and higher taxes creates an environment of uncertainty for residents and businesses.”

State Workforce

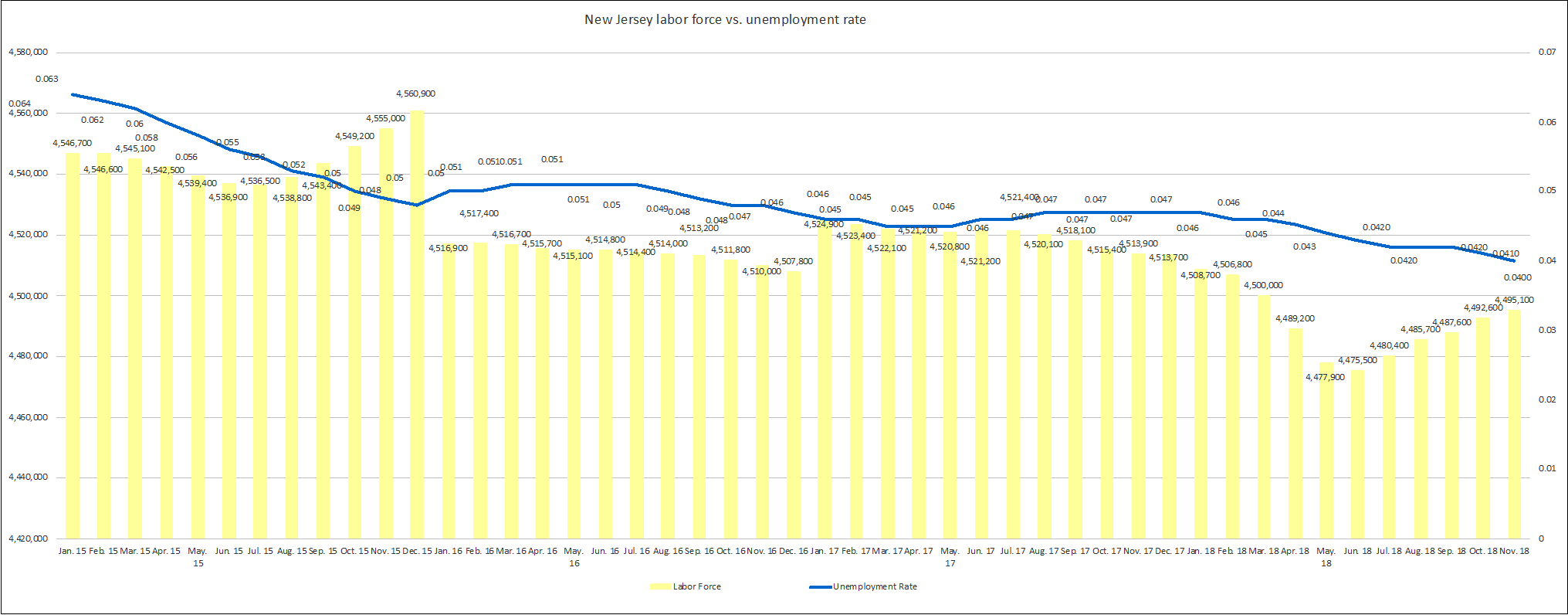

New Jersey’s labor force grew by 2,500 workers in November. Over the year, the state workforce is down 18,800 workers. This month’s growth was less than October’s labor force growth of 5,000 new workers.

The state’s growing workforce was made up of an increase of 7,700 more people reporting being employed and 5,400 less people reporting being unemployed.

Even though the rate of increase was slower this month, the Garden State has a clear trend of a growing workforce. But it follows an even longer trend (11 months) of the state’s workforce shrinking. With the average rate of workforce growth over the last five months, it would take another five months to recoup the number of workers lost over the last year.

The state’s unemployment rate dropped to 4 percent in November, down from 4.1 percent in October.

State job growth (and loss)

New Jersey lost 800 jobs over the month of November. Over the year, the state is up 61,900 private sector jobs and slightly lags the national job growth rate.

New Jersey Labor Force vs. Unemployment Rate, 1/15 – 11/18

The sectors that lost the most jobs were Professional and Business Services (-3,600 jobs), Information (-1,200 jobs), Financial Activities (-800 jobs), Leisure and Hospitality (-700 jobs) and Other Services (-400 jobs). Sectors gaining jobs were Education and Health Services (+2,100 jobs), Construction (+1,800 jobs), Trade, Transportation and Utilities (+1,300 jobs) and Manufacturing (+700 jobs).

Almost all of the sectors that lost jobs were white collar and reflect the statewide trend of companies and residents leaving New Jersey.

The state’s uncertain future

While this month’s jobs report had some positive news of a continued growing workforce, it arrives against the backdrop of a potentially rocky state economic landscape over the coming year.

Honeywell recently announced that they are moving their corporate headquarters out of New Jersey to more affordable and business-friendly North Carolina. The company is keeping approximately 1,000 jobs in New Jersey in order to keep its tax credit, but they clearly signaled that the North Carolina move was a business decision to bolster the company’s bottom line. Conagra Brands, which recently acquired New Jersey-based Pinnacle Foods, announced that it was shuttering operations in Cherry Hill and Parsippany, with 500 layoffs to follow, citing that is was “cost effective” to retain operations in the Midwest.

Also, while Governor Phil Murphy and the leaders of the state legislature are in a rhetorical battle over whether or not to raise taxes, the annual Business Outlook Survey from the New Jersey Business and Industry Association showed that businesses are weary of the tax and regulatory burden that New Jersey government is leveling on businesses.

With more jobs and companies leaving the state, the potential for another political showdown over tax hikes, and a mixed jobs report present an incredibly uncertain outlook for the state economy. Unless New Jersey’s economic growth makes substantial gains over the next few months, the state is at risk of even bigger losses when the next downturn hits.