Income Tax, ECONOMIC OPPORTUNITY FOR ALL, GDP

GSI Analysis: December ’19 Revenue Report – Why Are More Tax Increases on the Table?

-

Strong US economy and state tax hikes fuel revenue collections, 7.6% above last year

-

Collections in Income, Business & Sales Taxes are $1 Billion above last year

-

Results present an opportunity to make NJ more competitive

As New Jersey’s Department of the Treasury reported in today’s release of the December Revenue Report that tax collections are $1 billion above last year, Garden State Initiative’s president Regina M. Egea questioned Governor Murphy’s call for even higher taxes as part of his plan for New Jersey.

“Driven by a strong national economy and tax increases already enacted by Governor Murphy, the Treasurer is reporting that revenue collections are well ahead of last year, especially in personal income and business taxes, two of the three areas that shoulder the largest burden of funding our state government,” said Ms. Egea. “As part of Governor Murphy’s State of the State Address he called for even more revenue from tax increases. New Jersey residents have to be asking – “Why are more tax increases on the table?” If these robust revenue collections are used to reduce, rather than increase our tax burden, there is an opportunity to make New Jersey more affordable, make New Jersey more competitive, and get New Jersey back on the road to prosperity.”

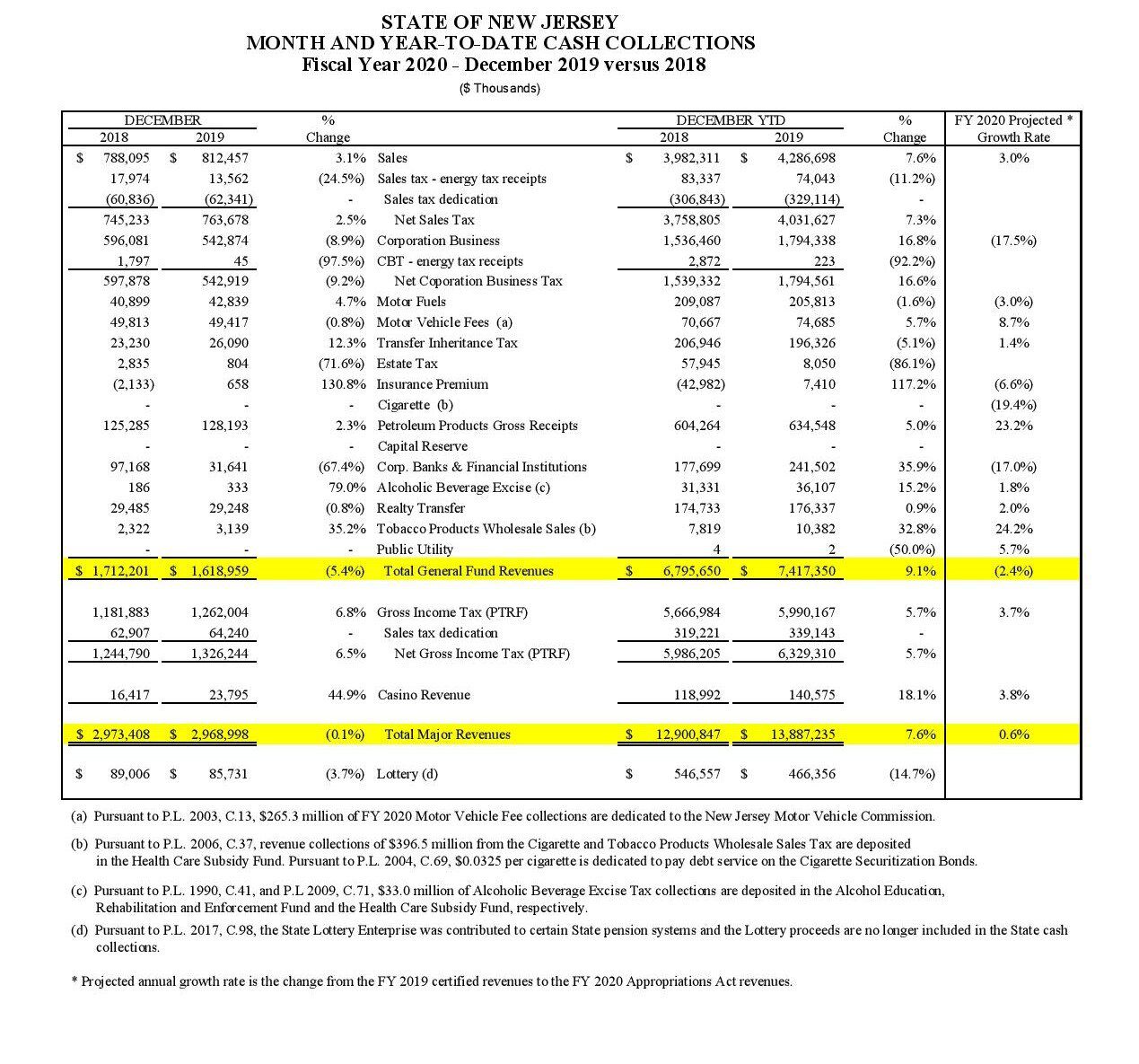

According to the Treasurer’s report for the first six months of the fiscal year, overall collections totaled $13.887 billion, up $986.4 million, or 7.6%, above the same six-month period last year. Corporate Business Tax (CBT) collections of $1.794 billion are up $257.9 million, or 16.8% higher than last year, the Gross Income Tax (GIT), the state’s largest source of revenue, totaled $5.990 billion, up $323.2 million, or 5.7% and the Sales Tax collections of $4.287 billion represent an increase of 7.6%.

Month and Year-To-Date Cash Collections